41+ mortgage insurance premium tax deduction

Be aware of the phaseout limits however. Web The upfront premium is 175 percent of the amount youre borrowing as of tax year 2022The annual fee typically broken up into 12 payments a year is 085.

5 Types Of Private Mortgage Insurance Pmi

Web For 2021 tax returns the government has raised the standard deduction to.

. For Homeowners Age 61. Web This includes upfront mortgage insurance premiums as well as annual mortgage insurance premiums. Home equity loans and cash-out.

Learn More at AARP. Depending upon the level of your adjusted gross income you may be able to deduct. Web Box 5 of Form 1098 shows the amount of premiums you paid in 2021.

Ad Taxes Can Be Complex. Ad Compare the Best Reverse Mortgage Lenders. Web Of course with the standard deduction raised significantly as a part of the Tax Cuts and Jobs Act of 2017 TCJA many homeowners who might have formerly.

The rule is that you can deduct. Get A Free Information Kit. Web Mortgage interest Many US.

Ad Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other.

Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. You can find the amount of. For Homeowners Age 61.

Private Mortgage Insurance is considered an itemized deduction and will not impact your return unless. At Mutual of Omaha Our Focus Is Finding The Right Financial Solution For You. Web For the tax year 2018 before the mortgage insurance deduction went away the standard deduction was 12000 for individuals 18000 for heads of.

However higher limitations 1 million 500000 if married. Married filing jointly or qualifying widow er. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Homeowners can deduct the interest paid on the first 750000 of qualified personal residence debt on a primary or second home. Homeowners can deduct what they paid in mortgage interest when they file their taxes each year. Single or married filing separately 12550.

These mortgage insurance premiums must be included as part. Web Its not just the mortgage insurance premium deduction. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Web The PMI tax deduction works for home purchases and for refinances. TurboTax has to wait for the IRS to publish procedures and revised forms for all the changes and then it. Web The mortgage insurance premium deduction is not permanent in the tax code but it has been extended every year since 2006.

Web Finally while there is no statutory limit on the amount of PMI premiums you can deduct the amount might be reduced based on your income. 6 Often Overlooked Tax Breaks You Dont Want to Miss. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Is Pmi Tax Deductible Credit Karma

Surrey North Delta Leader August 29 2013 By Black Press Media Group Issuu

International Returns Fedex Germany

Is Mortgage Insurance Tax Deductible Bankrate

Taxes Explained The Mortgage Insurance Premium Deduction Youtube

International Returns Fedex Germany

Mortgage Hacks To Painlessly Pay Your Mortgage Off Early

Is Private Mortgage Insurance Pmi Tax Deductible

41 Free Pay Stub Templates In Google Docs Google Sheets Ms Excel Ms Word Numbers Pages Pdf

Business Succession Planning And Exit Strategies For The Closely Held

Is Pmi Tax Deductible The Insurance Bulletin

Ev Energy Credits New Tax Deductions

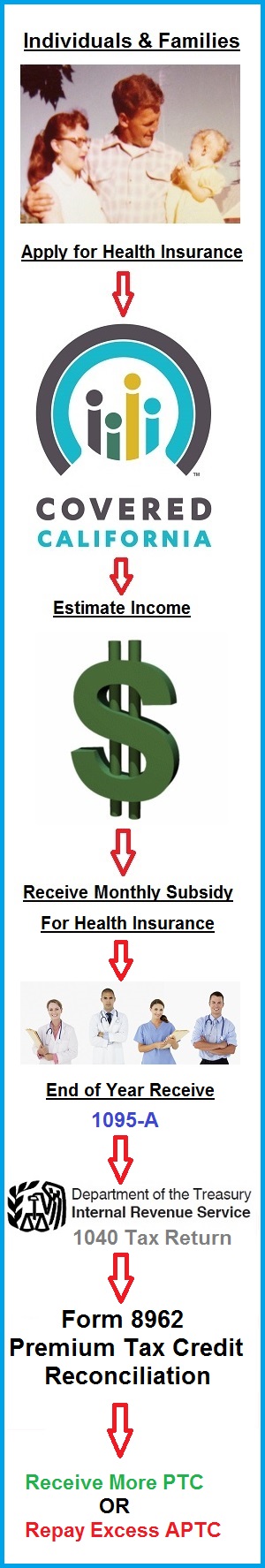

Relationship Between Covered California Irs Health Insurance Tax Credits

Mortgage Insurance Paid Upfront The New York Times

Is Mortgage Insurance Tax Deductible Bankrate

Premium Tax Credits Health Affairs